Random bits on raising Cocoa II, mostly for fund managers, but probably relatable to founders too.

Hola!

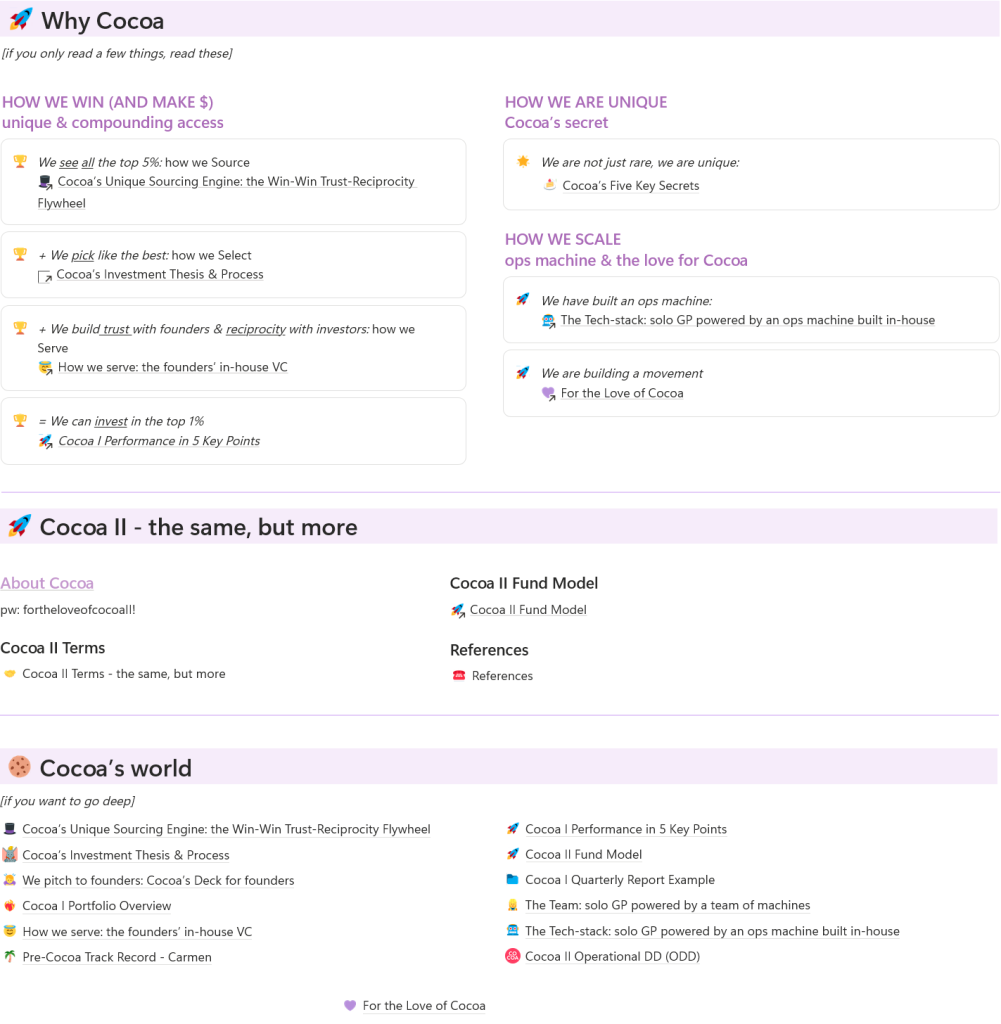

My name is Carmen, I’m the founder of Cocoa, an angel fund investing $500K checks in Killers with a Heart: brilliant beasts with a right to a secret, building because it’s inevitable to them. I was a VC for a long time before founding Cocoa; now I bring all my VC network and experience to support founders as their in-house VC and help them hack the system from the inside. More on Cocoa here.

But I’m not here to tell you about Cocoa’s thesis. I’m here to share my experience fundraising Cocoa II. I am infinitely grateful for Cocoa II – the LPs who backed us, the Cocoa founders who allow us the privilege to back them and everybody who supports Cocoa. And so I thought that a great way to celebrate Cocoa II could be by sharing my very personal fundraising experience, in case it could be helpful to anybody out there raising or about to raise.

Some time ago, someone asked me, “What’s the worst advice you ever got?”

“Anything that starts with ‘if I were you,’” I replied. I am not you, so please don’t take this as advice — take what resonates, leave what doesn’t.

Bit #1: The humans.

Cocoa I (2022) was a $17M fund, mainly backed by tech founders. Eternally grateful – there wouldn’t be Cocoa without Cocoa I.

Cocoa II (2025) is a $23M fund, anchored by Sapphire Partners (San Francisco), Alfred I. duPont Charitable Trust (Jacksonville), The Dietrich Foundation (Pittsburgh) and SITFO (Salt Lake City). And backed by other great institutions and incredible humans like Marktlink Capital, Integra Global Advisors, Speld, First Close Partners and more.

For Cocoa II, I wanted to optimise for LP experience, capital predictability and, if possible, mission. I know there’s a lot I don’t know, and I wanted to build Cocoa alongside people who’ve seen it all, across vintages, geographies and market cycles. And in searching for those humans, I learned that those who know the most are often the most humble and human.

Bit #2: The vertigo.

I never thought I was afraid of heights.

I remember, just before Sapphire was to decide, feeling like I was standing at the edge of two very different worlds. One where everything would stay the same -not bad, simply the same. And another, where everything could change for the better. At that point, it was out of my control. That might have been vertigo.

I felt it even more clearly after closing Cocoa II: the weight of responsibility that comes with trust. I was so lucky, grateful, and excited to have the backing of such LPs, but now I had to return that trust, many times over.

It was probably also vertigo on those late nights when I stared at the LP pipeline, searching for levers to pull.

Bit #3: The formula.

Looking back, I’ve come to realise that Cocoa II is the product of hard work × everyone’s support × good luck.

I guess, like so much else in life.

Bit #4: Who cares?

While you’re fundraising, you might read tons of other funds’ announcements. Don’t read the part about how fast they raised or how oversubscribed they were. Who cares? What matters is building your fund with the kind of humans and capital that fit you and your strategy, so you’re in the strongest position to deliver the best returns.

I won’t share Cocoa’s target versus final size, or how long it took to close. I’ll just share that I don’t like the number 23. I’ve always preferred even numbers, ever since I was little. One night I told my husband: “L, I don’t like the number 23”. “It’s Michael Jordan’s number”, he said, as if it were obvious. That was it. 23 it is.

Bit #5: The silence.

You’ll hear many things back.

Some will make sense: the portfolio is too young; if those are your best companies, why haven’t they been marked up yet?; we believe in funds that follow on; we like thematic funds; we have moved to deeptech funds only; we’re focusing on US funds; we only do big funds; we only do smaller funds (that one I never heard!). And that’s all okay. We pass on founders too – it’s part of the business that not every LP will like your model, or even you.

Others will come from condescension, ignorance, or outright lack of respect. You’ll also get a lot of silence. And even though that’s not so okay, it ultimately is not important – it wasn’t a fit. Turn the frustration into something positive: empathy, and more respect for the founders we have the privilege to back. Then carry on with your full force.

Bit #6: The cold email.

The Alfred I. duPont Charitable Trust, Cocoa II’s first anchor, who would later introduce me to Ed and Ryan at The Dietrich Foundation, reached out cold. One afternoon I got an email: other GPs had mentioned Cocoa, and they’d love to meet and learn more. A children’s healthcare foundation … you can understand why part of me thought it was a scam. But of course, I agreed to meet Sean and Charlie, and we went for hot chocolate.

I really enjoyed that hot chocolate but left thinking the duPont Trust would never consider a fund as small as Cocoa. Still, I thought they might invest in some larger European funds, and Europe needs more Seans and Charlies, so I started sharing my thoughts on the European market and forwarding the Cocoa I GP letters as I sent them out. And then, one day, a few months later, they went into due diligence.

I still don’t know which GPs mentioned me. But if you were one of them, please come forward – I owe you a lifetime of chocolate.

Bit #7: The full circle.

Beezer, an institution in herself, was the first LP I ever met. 10 years ago, at Felix Capital’s first AGM. Through all these years, she’s been both a cheerleader and an inspiration. She embodies so much of what I aspire to become — fiercely brave, brilliantly sharp and generously empowering. Now, she’s Cocoa II’s anchor. And she’s brought with her Laura, Nate and Dan. I couldn’t imagine a more perfect circle.

Bit #9: The rigour.

I am from Spain – that’s hard to hide and I love it! But I studied in a German school and spent some time in a US school. And I spent three years at Morgan Stanley IBD. This all to say that something dies in me when a bullet point is not consistently aligned (and Ed from Dietrich always spots it, which warms my heart because it means he reads everything I write).

I’m a firm believer that rigour matters. We are asking LPs to trust us with their money, and with that comes big responsibility. Such responsibility and respect to it is at the core of how I build Cocoa, including the fundraising materials. We shared every possible number, sliced the portfolio a thousand ways, recorded Looms to show our processes, and opened the doors to Cocoa and my brain wide open. And, of course, added a few gifs to keep it colourful :).

Bit #10: The bets.

How can you make it work with small stakes? Why don’t you follow-on? Does a generalist fund have access to the best founders? How can you pick well if you are not a sector expert? Will you not give in to the temptation of raising larger funds? Are you too nice?

Cocoa is built upon a lot of bets that are not necessarily obvious. I made sure to lead with them: the first slide of Cocoa II’s deck laid out Cocoa’s core bets and the hypothesis behind them. In fact, I named Cocoa II fundraising deck About Cocoa 🍫.

Bit #11: The question.

Ed from First Close asked me, “What funds in Europe should we invest in?” I went on and on, enthusiastically listing all the funds I admire in Europe.

“You haven’t mentioned Cocoa”, he said.

Oh dear Europe.

Bit #12: The trade-offs.

This is hard. Small fund, big fund, it’s hard for everyone.

I get asked about burnout a lot. I can’t know if I’ll ever experience it. What I do know is that Cocoa is both the joy of my life and the hardest thing I’ve ever done. There’s a lot of power in being small, and also a lot of trade-offs that I deal with every day. But I have a healthy relationship with the hard parts, because I chose these trade-offs over others. They’re my trade-offs.

Bit #13: The believers.

When duPont Trust confirmed, I told my friend J that I felt so much gratitude. J, American as she is, reminded me that I had nothing to be grateful for – they invested because they loved Cocoa and were convinced they’d make money. I understand what she means. But I’m grateful nevertheless, because in a world where most investors (myself included) inadvertently default to looking for reasons not to invest, a major U.S. LP decided to invest in a small fund out of London. And that’s not obvious. The same goes for Sapphire, Dietrich, and SITFO.

I have all their commitment emails framed at CocoaHQ, to inspire me every day to stay curious, take the time to explore, and have the conviction to look for reasons to invest.

Bit #14: The screening.

Going from commitment to signature with very institutional investors is a process of its own. During that time, I remember joking that every night I’d get a kind slap — since most of the LPs were in the U.S., the slap always came in the evening.

I remember one night, walking back to the office from an event, when I got an email that read:

Hi Carmen,

Hope all is well – thank you for taking the time to complete our background check process.

Our vendor recently provided the report and although the report was mostly clean, they did note a discrepancy in the type of degrees received at Comillas Universidad Pontificia. They were able to confirm completion of two (2) bachelor’s degrees (Law and Business Admin), but have no record of receiving a Masters degree, as shown on your bio in LinkedIn.

Attached is the email from the university. Is there any additional context you can provide on your educational background?

You can imagine what went through my head: Oh my, what did I write on LinkedIn twelve years ago? Thankfully, I knew exactly what it was about. I replied with my MECES Correspondence Certificate, and it all got sorted that same evening. But I must confess my blood did freeze for a second.

Bit #15: The momentum.

The eternal challenge.

I fundraised Cocoa II in my own style, and not just because I brought chocolate to every meeting. I didn’t give LPs a timeline. Others do, and it works. In my case, I wanted everyone to have the time to get to know Cocoa and enjoy the process. It was very Cocoa, and that’s probably why it worked.

Bit #16: The village.

People say I’m a solo GP. I don’t particularly like that. As I see it, you can’t build a fund solo, and Cocoa II would never have been raised without the support of the whole ecosystem.

duPont Trust reached out cold because multiple people had mentioned Cocoa to them. So did Cocoa II’s first ever check, from T. L and R made a million intros to their LPs. I kept sending me spreadsheets full of names to target. H introduced me to SITFO. M, J and S kept sending me deals, while I was on the road fundraising. D bought me cookies. My mum went to light candles to the Virgin before every IC. D’s mum prayed to Buddha. I had every religion rooting for Cocoa II.

And there was an army of people making reference calls: L, O, S, E and so many more of you who devoted endless 30-minute slots to making Cocoa II happen. And all the Cocoa founders, whose time I’m supposed to protect, made space to speak to LPs – to tell them about that theatre night seeing Dear England; or to confess that in every fundraise I cite Don Juan and constantly remind them to be “desirable” (for lack of a better word) and unattainable.

Even the LPs. Integra committed early to support the fundraise. Marktlink told me to use their name months before they committed, in case I needed to build momentum. Sapphire and duPont worked so hard to help other institutions DD. A doubled his commitment when he thought I needed it, and then kindly made space when we wanted to bring in another institution.

AngelList bent their own systems to accommodate the requirements from the big institutions and they even manufactured the timing so the official closing of the fund would fall on my husband’s birthday. Chris at Reitler elegantly waited for the fund to close before invoicing (he never mentioned it, but I know).

Rally your people. Lean on them. Celebrate with them.

Bit #17: The gift.

It’s through this fundraise that I realised my parents raised my sister and me under the unspoken assumption that the world is equal. They ingrained in us that we are not entitled to anything, but that whatever we work for is ours to achieve, under the same conditions as anyone else. Though we’re two very different humans, my sister and I both have the confidence of those who know they are unconditionally loved.

It’s also through this fundraise that I realised the world might not be totally equal yet. But equal or not, the world is there for us to grab. That’s instinctive to me. And whoever looks at you and can’t see that – it’s not your problem, it’s theirs. You be more you, the world is yours.

Bit #18: The world rewards authenticity.

I’m a girl who dresses in pink trousers, bright jumpers and Cocoa-colour sneakers. I personalize chocolate bars and give away holographic stickers that read Killers with a Heart. And my Dataroom and Quarterly Reports are full of colour.

I also work as hard as hard can humanly be. And I pour every bit of my brain and my heart into Cocoa and Cocoa founders every day, my way. And now Cocoa II is backed by some of the best LPs and humans in the industry.

The world rewards authenticity, and I’m grateful for it.

Bit #23: Inevitable.

One day, when you know that this is it, that you got your fund, with the right people around the table, you might find yourself looking back and thinking – how in the world did I push through all those meetings, all those rejections, all those airports. And you might realize that you had never asked yourself that question while out there. Because raising this fund, building this firm, investing in these founders, was inevitable to you. There’s no world in which you don’t see this through. That’s why you will manage.

All the best of luck,

Carmen 🍫

Cocoa II Fundraising Diaries